Cash Secured Put Strategy in the Indian Market

In the intricate world of options trading, the secured put strategy emerges as a nuanced approach for investors looking to enhance their investment portfolio with a focus on the Indian market. This strategy, often overshadowed by more commonly discussed techniques like covered calls, offers a distinctive blend of income generation and potential stock acquisition, tailored to fit the conservative investor’s playbook. This article aims to unfold the layers of the secured put strategy, offering insights into its workings, benefits, risks, and practical applications within the Indian context.

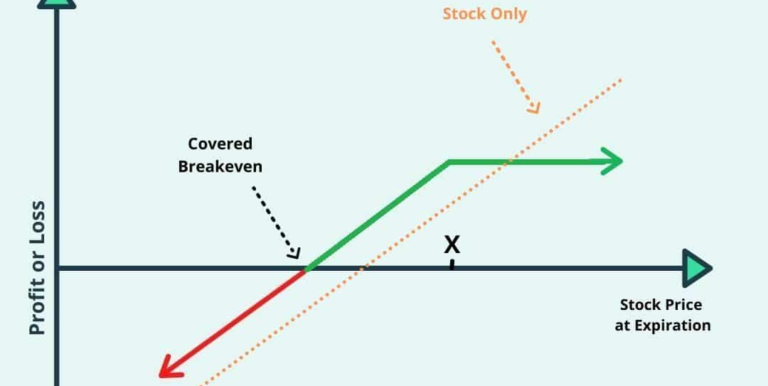

Introduction to Secured Puts

A secured put strategy involves the investor selling (writing) put options while simultaneously setting aside sufficient funds to purchase the underlying stock if the option is exercised. This method is “secured” because the investor is prepared to buy the stock at the strike price, ensuring they can fulfill the obligation without needing additional capital. This strategy is particularly appealing in the Indian market, where investors often seek ways to enter stock positions at a discount or generate income on idle cash.

How It Works

- Selling Put Options: The investor sells put options on a stock they wish to own, receiving the option premium upfront. In the Indian market, this typically involves stocks listed on the Bombay Stock Exchange (BSE) or the National Stock Exchange (NSE).

- Securing the Purchase: The investor reserves enough cash to buy the stock at the option’s strike price. This cash reserve is essential for covering the obligation if the option is exercised.

- Potential Outcomes: If the stock price remains above the strike price at expiration, the put option expires worthless, and the investor retains the premium as profit. If the stock price falls below the strike price, the investor is obligated to buy the stock at the strike price, potentially at a discount to the current market price.

Benefits of Secured Puts

Income Generation

The immediate receipt of the option premium provides a straightforward income stream. This strategy can be particularly lucrative in the Indian market, where investors look for alternative income sources beyond dividends.

Acquiring Stocks at a Discount

Secured puts offer a strategic pathway to purchase stocks at a lower price. By choosing a strike price below the current market price, investors can potentially buy desired stocks at a discount if the option is exercised, which is an attractive proposition in the high-growth Indian market.

Risks and Considerations

Potential for Stock Ownership at a Loss

If the stock’s price falls significantly below the strike price, the investor might have to buy the stock at a higher price than the current market value. This scenario requires careful stock selection and market timing to minimize potential losses.

Opportunity Cost

The funds set aside to secure the put option represent an opportunity cost, as they cannot be used for other investments. Investors must weigh this against the potential benefits of the strategy.

Implementing Secured Puts in India

Selecting the Right Stocks

For the secured put strategy to be effective in the Indian context, investors should target stocks with solid fundamentals, strong growth prospects, and a history of stable performance. Blue-chip stocks or those from sectors with long-term growth potential are ideal candidates.

Understanding Market Dynamics

Successful implementation of secured puts in India requires a deep understanding of market dynamics, including factors affecting stock prices such as economic indicators, corporate earnings reports, and geopolitical events. Staying informed helps investors make timely decisions about selling put options.

Case Study: TATA Motors

Consider a scenario involving TATA Motors, a prominent player in the Indian automotive sector. An investor interested in TATA Motors could sell a put option with a strike price slightly below the current market price for a one-month expiry, receiving a premium in return. If TATA Motors’ stock remains above the strike price, the investor profits from the premium. If the stock price drops below the strike price, the investor acquires shares at the predetermined price, potentially lower than the market price at the time of option sale, and can benefit from future appreciation as the market corrects.

Conclusion

The secured put strategy offers a strategic avenue for investors in the Indian market to either generate income through premiums or purchase stocks at a preferred price point. While it carries risks, such as the obligation to buy the stock at a potentially unfavorable price, the strategy’s benefits can outweigh these risks for well-informed and strategic investors. By carefully selecting stocks, understanding market dynamics, and employing a disciplined approach, investors can effectively leverage secured puts to enhance their investment portfolio’s value and performance in the vibrant and diverse Indian market.